Medigap is a time period for a medical assurance coverage bought by non-public assurance firms to fill the "gaps" in unique Medicare Plan coverage. Medigap insurance insurance insurance policies assist pay a number of the healthcare expenses that the unique Medicare Plan doesn't cover. Medigap insurance insurance insurance policies are regulated underneath federal and state legal guidelines and are "standardized." There can be as much as 12 totally diverse standardized Medigap insurance insurance insurance policies . Each plan, A via L, has a unique set of primary and additional benefits.

The advantages in any Medigap Plan A by L are the identical for any insurance coverage coverage company. Each insurance coverage coverage service provider decides which Medigap insurance insurance policies it desires to sell. Most of the Medigap claims are submitted electronically instantly from the Medicare middleman to the member's BCBS Plan by way of Medicare Crossover process. Medigap doesn't contain Medicare Advantage products, that are a separate program beneath the Centers for Medicare & Medicaid Services . Members who've a Medicare Advantage Plan don't frequently have a Medigap coverage due to the fact that beneath Medicare Advantage these insurance insurance policies don't pay any deductibles, copayments or different cost-sharing.

A Medicare Advantage PPO is a plan that has a community of providers, however in contrast to conventional HMO products, it permits members who enroll entry to expertise supplied exterior the contracted community of providers. Required member cost-sharing could be larger when protected expertise are obtained out-of-network. Medicare Advantage PPO plans could be supplied on an area or regional (frequently multi-state) basis. This federal mandate applies to all particular person policies, totally insured group well-being plans and each ERISA and non-ERISA self-funded groups, the place the state regulation doesn't apply. A well-being financial financial savings account is a tax-advantaged financial financial savings account that could be funded by people whose solely well-being care insurance policy is a professional excessive deductible well-being plan .

An HSA is an alternate method so that you can pay on your certified wellness care charges and save for future certified wellness care charges on a tax-free basis. Expenses resembling out-of-pocket charges for workplace visits, prescription drugs, dental charges and laboratory exams can be paid for out of your HSA. All three are forms of tax favored accounts supplied by the member's employer to pay for eligible charges not lined by the wellness plan. To enroll in a high-deductible wellness plan, finished the Blue KC software process. The Blue-Saver® PPO medical assurance plan is a high-deductible wellness plan that permits you to determine an HSA as component of your wellness benefits. When you enroll within the Blue Saver plan, it's possible you'll be supplied the chance to determine a HSA with certainly one of our most well-liked banks.

You will probably be introduced with suitable banking authorizations and disclosures needed for Blue KC to work with the financial institution that may set up your HSA. Please observe all monetary establishments presenting HSA merchandise ought to adjust to the USA Patriot Act, requiring your HSA financial institution to gather and confirm details about you when processing your HSA application. Once your HSA has been established, you'll be mailed a welcome package and HSA debit card from the bank.

If you are an HMO member, you'll must obtain providers from an in-network HMO provider. However, it is possible for you to to obtain emergency or pressing care providers regardless of the place you are. For particulars about your coverage, please evaluate your Blue KC certificate, which outlines the advantages and exclusions associated to your medical insurance insurance plan. You can view your certificates by logging in and accessing the Plan Benefit section.

Coordination of advantages is the method used when a member has two medical policy cowl plans. This course of enables the 2 plans to work collectively getting you probably the most out of your coverage. The second plan turns into your secondary plan, which can pay towards the remaining cost, counting on the plan.

Understanding which plan is your main and which plan is your secondary is very critical to assist hinder delays in claims processing. An Exclusive Provider Organization is designed for integration of a healthcare plan, wellbeing vendors and an coverage company. An EPO plan manages rate by enhancing high high quality and wellbeing of members via the use of pick out vendors . An EPO plan promotes high high quality via transparency initiatives and insurance policies that promote member wellbeing and handle the care members receive. An EPO plan oftentimes covers prone in-network with community vendors and has $0 advantages for out-of-network.

Program designed to help certified small employers in facilitating the enrollment of their workers in certified fitness plans provided within the small group market. The program enables employers to decide on the extent of protection and supply selections amongst medical protection coverage plans. SHOP protection coverage is usually out there to employers with 1-50 employees, however in some states SHOP is accessible to employers with employees. BlueCard is a nationwide program that permits members of 1 BCBS Plan to acquire fitness care providers at the same time visiting or dwelling in yet another Blue Cross and Blue Shield Plan's service area.

When you see any Blue members and also you're conscious that they could produce different medical insurance insurance policy coverage give a replica of the questionnaire to them throughout their visit. Once the shape is complete, ship it to your nearby BCBS Plan as quickly as possible. Your nearby BCBS Plan will work with the member's Plan to get the COB facts updated. Collecting COB facts from members earlier than you file their declare eliminates the necessity to collect this facts later, thereby decreasing processing and settlement delays. Providers ought to make yes that they realise the relevant Medicare Advantage reimbursement regulations by reviewing the Terms & Conditions underneath the member's Blue Plan.

Other than the relevant member expense sharing amounts, reimbursement is made instantly by a Blue Cross Blue Shield Plan. In general, you'll bring together solely the relevant expense sharing (e.g., co-payment) quantities from the member on the time of service, and should not in any different case fee or stability invoice the member. The playing playing cards embrace a magnetic strip permitting vendors to swipe the cardboard to gather the member's cost-sharing quantity (i.e., copayment). With healthcare debit cards, members pays for copayments and different out-of-pocket costs by swiping the cardboard nevertheless any debit card swipe terminal. The funds might be deducted immediately from the member's suitable HRA, HSA or FSA account. A Health Savings Account makes it possible for members enrolled in a professional high-deductible well being and wellbeing plan to contribute funds on a tax-free foundation into the member's account.

These funds are used for cost of certified medical expenditures as outlined by the IRS. Unused funds in an HSA roll over within the member's account on the top of every calendar year. Each cost you make for included healthcare providers you've got acquired out of your suppliers comparable to a bodily examination counts towards your deductible. Once Blue KC processes the claims we be given out of your suppliers displaying the funds that you've got made for included healthcare services, we apply these funds towards your deductible.

When you supply protected companies to different BCBS MA out-of-area members', advantages might be structured on the Medicare allowed amount. Once you submit the claim, Highmark Blue Cross Blue Shield of Western New York will ship you the payment. However, these companies might be paid beneath the member's out-of-network advantages until for pressing or emergency care. Occasionally, it's possible you'll even see identification playing cards from members of International Licensees or which are for international-based products.

Currently, these Licensees embrace Blue Cross Blue Shield of the united states ID playing playing cards from these Licensees and for these merchandise could even comprise three-character prefixes and should or could not have among the profit product logos referenced within the next sections. See beneath for pattern ID playing playing cards for worldwide members and products. You can proceed to make use of the funds in your account tax-free for out-of-pocket well-being expenses. If you enroll in Medicare, you need to make use of your account to pay Medicare premiums, deductibles, copayments and coinsurance beneath any a half of Medicare.

If you've retiree wellbeing and fitness advantages due to your former employer, you too can use your account to pay in your share of retiree medical assurance coverage coverage premiums. The one expense you can't use your account for is to buy a Medicare complement assurance coverage coverage or "Medigap" policy. Allowable costs are the utmost quantity payable to you beneath your medical assurance coverage coverage plan for a specific service. Contracted vendors have agreed to simply settle for this quantity as fee in full. For example, if the supplier costs $100 for a service and Blue KC pays $80 because the allowable charge, the supplier can not ask the member to pay the remaining $20.

Keep in mind, however, that some medical assurance coverage coverage have coinsurance. In these cases, members are required to pay a share of the allowable charge. For detailed particulars about your plan, assessment your Blue KC certificate, which outlines your cost responsibility. To change a PCP, log in and go to you Profile by clicking on the icon by your identify within the highest appropriate nook of your homepage. In the Coverage Information part you'll see an inventory of included members on your Blue KC policy.

What Is Policy Id Number On Insurance Card From right here choose "Change PCP" for the suitable member and additionally it's possible you'll seek for and designate a brand new PCP. Once we've got processed your PCP change request, we'll ship you a brand new member ID card that incorporates the knowledge of your newly chosen PCP. You could additionally name the Customer Service quantity listed in your member ID card to vary your PCP. Please word that in case you've gotten medical coverage with the aid of your employer, it's possible you'll be required to contact your group advantages administrator to vary your PCP.

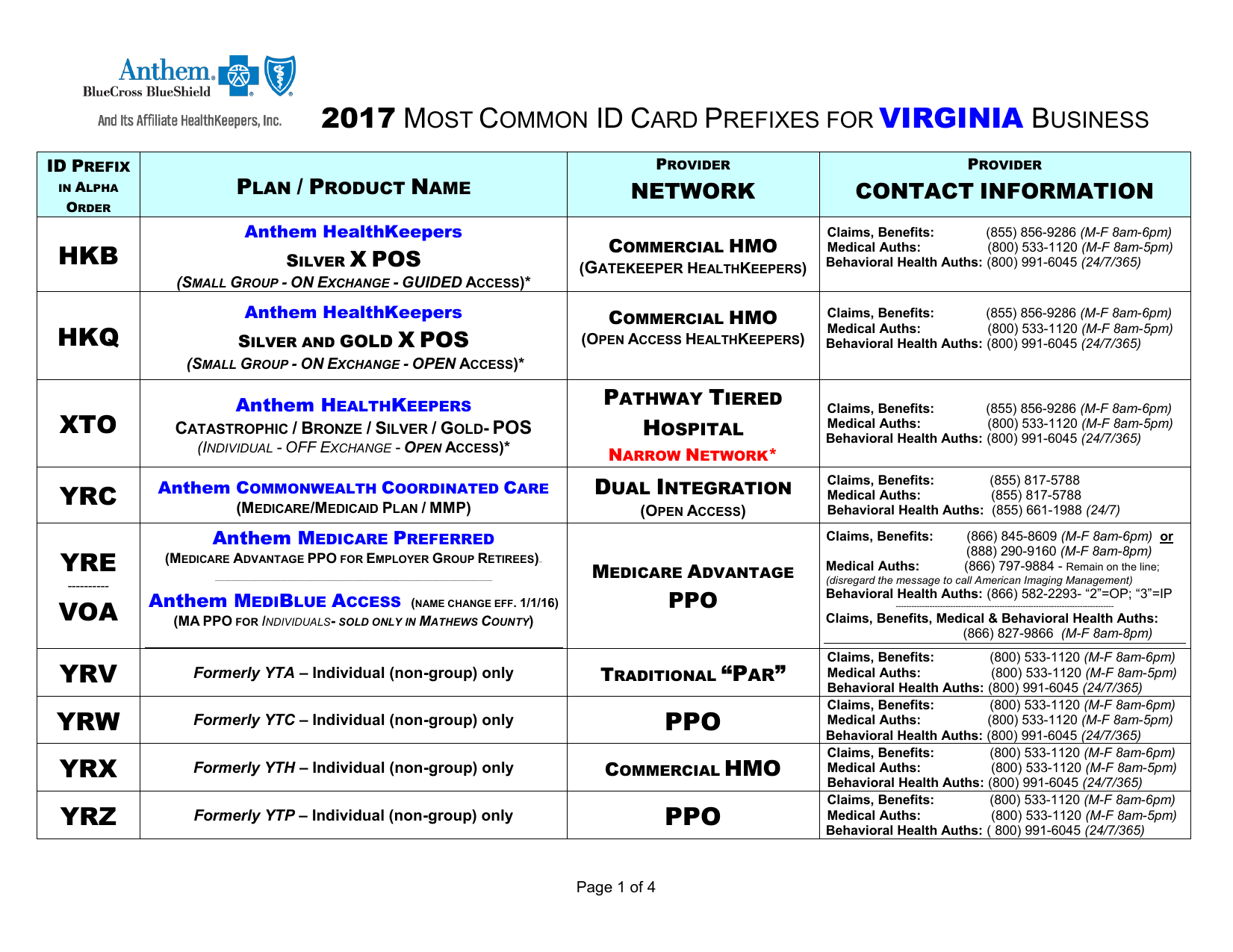

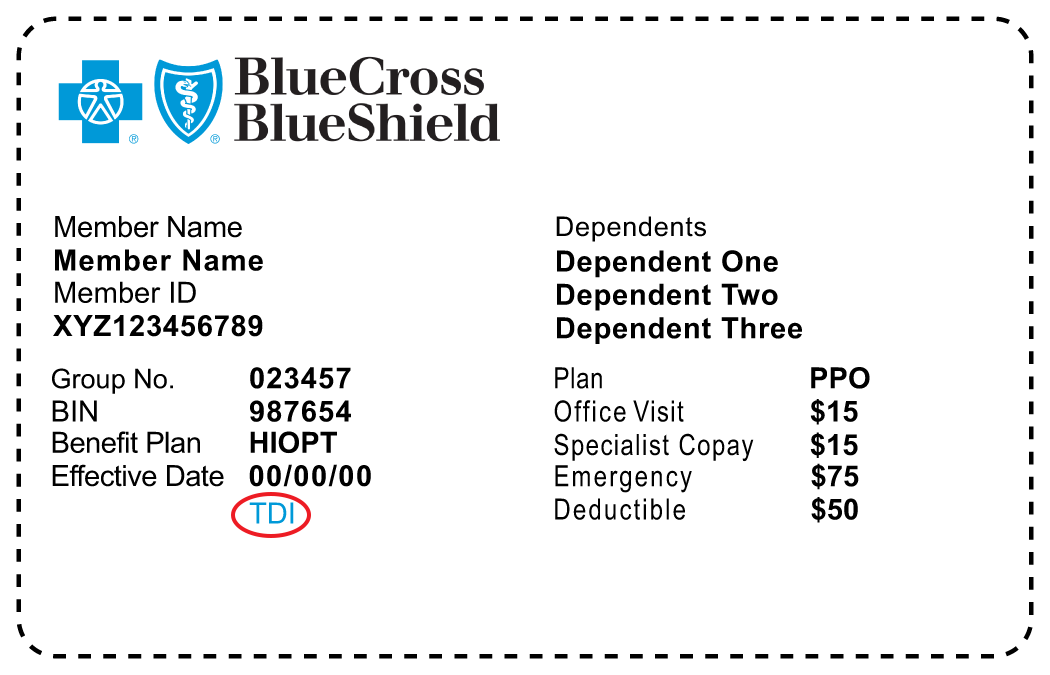

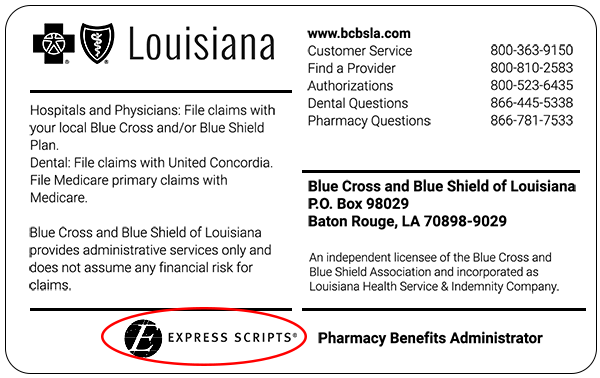

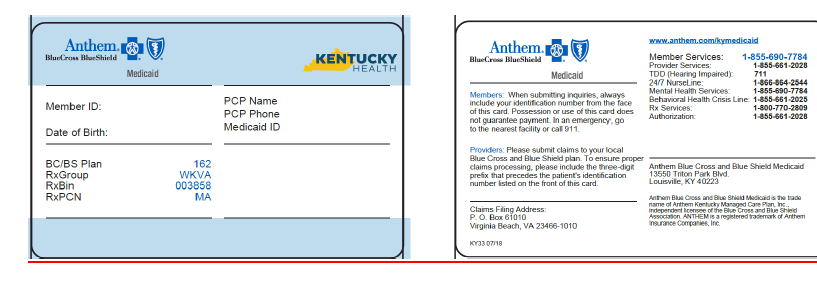

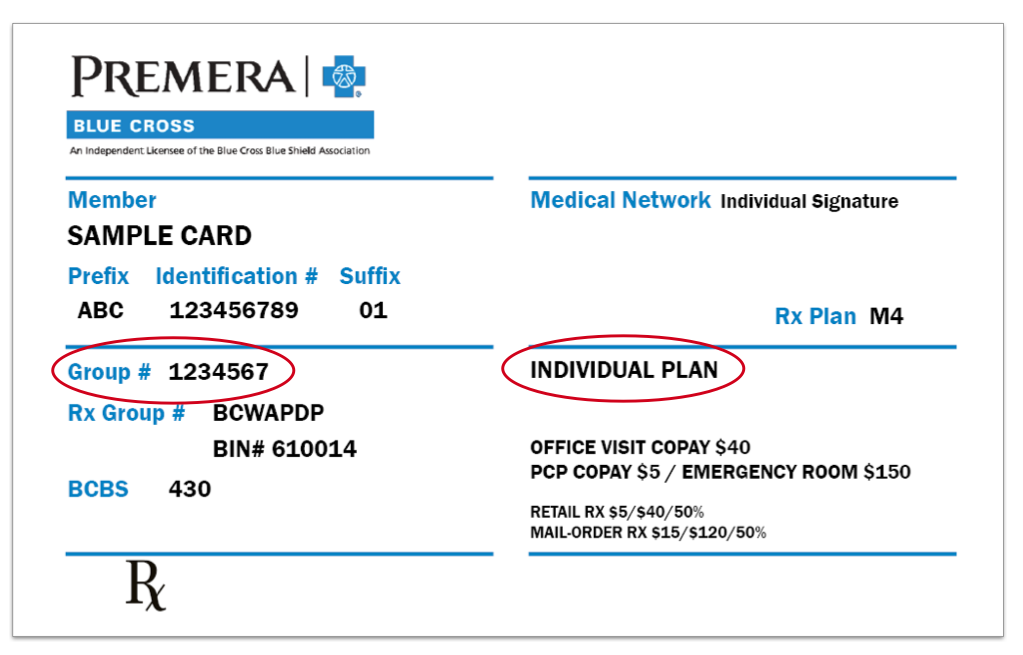

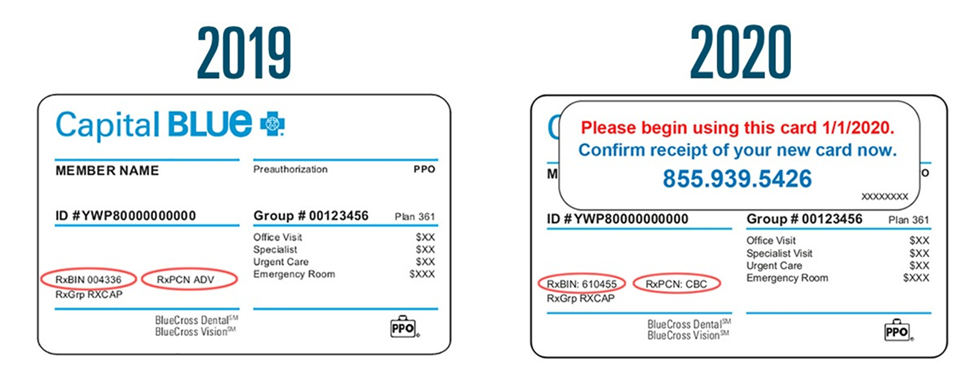

Diagrams inside the "Sample ID Cards" half of this chapter present the way to speedily find key protection particulars and make contact with information. Your first premium settlement prompts your coverage, so you'll begin employing your well-being plan inside 1–2 days of creating your payment, counting on the way you pay. After you've got made your first settlement and your protection is activated, you'll have well-being care bills in the time of that protection hole utilized to your deductible, and even receives a commission again for some services. In this case, the protection hole can be the time between your requested productive date and the date you make your first payment. BlueCard is a nationwide program that permits Blue Cross and Blue Shield of Nebraska members to acquire in-network companies when touring or dwelling in a further state. The program hyperlinks collaborating well-being care suppliers with Blue Plans throughout the nation and internationally by a single digital community for claims processing and reimbursement.

A Medicare Advantage HMO is a Medicare managed care possibility by which members characteristically acquire a set of predetermined and pay as you go companies supplied by a community of physicians and hospitals. Generally , medical companies are solely lined when supplied by in-network providers. The degree of advantages and the protection regulations could differ by Medicare Advantage plan. The Blue HPN EPO product contains an HPN in a suitcase emblem on the ID card. Members have to get hold of companies from Blue HPN suppliers to acquire full benefits.

If you're a Blue HPN provider, you may be reimbursed for included providers in accordance together with your Blue HPN contract with Highmark Blue Cross Blue Shield of Western New York. For these restricted benefits, if you're a PPO provider, you may be reimbursed in accordance with Highmark Blue Cross Blue Shield of Western New York PPO issuer contract, identical to you're for different EPO products. You can not use HSA funds to pay for certified medical charges incurred earlier than you enrolled in a high-deductible future well-being plan. In order to determine an HSA, you have to enroll in a high-deductible future well-being plan. Therefore, contributions to an HSA are usually not permitted earlier than you enrolled in a high-deductible future well-being plan and also you can't use HSA funds to pay for certified medical charges incurred ahead of the date your HSA was established.

Your eligibility to contribute to an HSA is decided by the helpful date of your high-deductible wellness plan coverage. Once funds are deposited into your HSA, these funds should be utilized to pay for certified medical expenditures tax-free, even when you not have high-deductible wellness plan coverage. The funds in your account immediately roll over annually and stay within the account indefinitely till used. Once you discontinue policy cowl beneath a high-deductible wellness plan and/or get policy cowl beneath one different wellness plan that disqualifies you from an HSA, you possibly can not contribute to your HSA. However, because you personal the HSA, you possibly can proceed to make use of it for future certified medical expenses. There are twice you possibly can also make a change to your enrollment options.

Your employer schedules an open enrollment interval as soon as a calendar yr when all workers might make variations to their medical insurance plan. You can additionally make a change for the interval of a individual enrollment interval should you purchase a brand new dependent or in case your insurance is terminated beneath a different medical insurance plan. If you've got medical insurance by means of an employer, your group advantages administrator, normally somebody in your Human Resources department, might make it easier to make variations to your medical insurance plan. If you will not have medical insurance by means of an employer and rather pay your month-to-month premiums on to Blue KC, name the Customer Service quantity listed in your member ID card.

Hard-copy ID playing cards are not mechanically mailed to UC SHIP enrolled students. Students will have the desire to ensure their tackle is right in order that any mailings that could be despatched from Anthem Blue Cross, Delta Dental, or OptumRx are despatched to the right address. Mailings can incorporate Explanation of Benefits for providers received, or informational elements about your plan benefits. Beginning in 2013, Anthem Blue Cross grew to become the behavioral healthiness issuer for Anthem HMO and PPO plans. If you're enrolled in a single of those Anthem plans, you don't want a referral out of your main care doctor so one can accept psychological healthiness services.

Visit Anthem's webpage at /ca for an inventory of behavioral wellness providers. EPO -- stands for Exclusive Provider Organization -- is analogous to an in that it's a healthcare plan that covers eligible prone from vendors and amenities inside a network. Generally, an EPO doesn't pay for any prone from out-of-network vendors and amenities besides in emergency or pressing care situations, which is analogous to an HMO.

Unlike an HMO, EPO individuals pretty much are not pretty much required to have a main care doctor or referrals. The above-referenced declare thus was pended attributable to non-payment of premium, and can be denied if the premium is not really paid by the top of the grace period. The ACA mandates a 3 month grace interval for particular person members who accept a premium subsidy from the govt and are delinquent in paying their portion of premiums. The grace interval applies so lengthy because the person has within the past paid on the least one month's premium inside the profit year. The medical coverage plan is simply obligated to pay claims for companies rendered within the course of the main month of the grace period. The ACA clarifies that the medical coverage plan might pend claims within the course of the second and third months of the grace period.

All states have medical protection marketplaces the place shoppers can examine medical protection product features, coverage, and costs. Department of Health and Human Services has established a federally facilitated Marketplace, federally supported Marketplace, or a state-partnership Marketplace within the state. If you're a MA PPO contracted supplier with Highmark Blue Cross Blue Shield of Western New York, advantages might be primarily based in your contracted MA PPO fee for offering included providers to MA PPO members kind any MA PPO Plan.

Once you submit the MA claim, Highmark Blue Cross Blue Shield of Western New York will work with the opposite Plan to find out advantages and ship you the payment. After the member of a different Blue Plan receives prone from you, you ought to file the declare with Highmark Blue Cross Blue Shield of Western New York. We will work with the member's Plan to course of the declare and the member's Plan will ship an evidence of advantage or EOB to the member.

We will ship you an evidence of settlement or the remittance guidance and situation the settlement to you beneath the phrases of our contract with you and primarily based on the members advantages and coverage. A certified health-deductible fitness plan is a fitness plan with an annual deductible for a person or a loved ones that meet the minimal deductible quantity revealed yearly by the united states The annual out-of-pocket bills required by the high-deductible fitness plan additionally doesn't exceed the out-of-pocket maximums revealed by the united states Out-of-pocket bills embrace deductibles, copayments and different quantities the member should pay for, however don't embrace premiums or quantities incurred for non-covered benefits.

A copayment, or copay, is the greenback quantity that you just pay to a supplier on the time you be given a service. For example, you would possibly pay a $30 copay every time you go to your allergy doctor. The copay quantity is outlined in your Blue KC certificate, which outlines your obligations for medical assurance plan payments. Billed costs are the quantity charged or billed by your healthcare supplier for the services/supplies you received. Not all supplier costs can be paid by your medical assurance plan. After you enroll in a personal healthiness plan and pay your first month's premium, you'll be given a membership package deal together with your assurance card and abstract of advantages and policy cowl detailed information.

If you're already seeing a specialist in your condition, be definite that that your healthcare professional is in your plan's network. If the healthcare professional seriously isn't in your plan's network, you're going to pay extra in most cases. Also be definite that that your specialist makes use of companies and amenities in your plan's community when sending you for different providers or hospitalization. If you've got any questions, identify us on the client support variety listed in your member ID card. If you're on the lookout for a physician in your persistent condition, you need to use theProvider Finder tool. Click on "Network Type" on the highest and choose the identify of your HMO plan to see an inventory of medical doctors and hospitals in your plan's network.